Intrinsic Value Assessment Of Eaton Corporation PLC (ETN)

By David J. Flood From The Investor’s Podcast Network | 15 January 2018

INTRODUCTION

Eaton Corporation PLC is multinational power management company. Its principal business involves the development, manufacture, and sale of products used in the management of electrical, hydraulic and mechanical power. Since its founding in 1911, the company has grown to become one of the world’s largest power management companies with 96,000 employees and business interests in 175 countries. Eaton Corporation PLC is currently a member of the Fortune 500 list with a market cap of $35.9 Billion. Its revenues and free cash flows for the previous financial year were around $19.7 Billion and $2 Billion respectively. The company’s common stock has fluctuated between a low of $67 and a high of $82 over the past 52 weeks and currently stands at around $81. Is Eaton Corporation PLC undervalued at the current price?

THE INTRINSIC VALUE OF EATON CORPORATION PLC

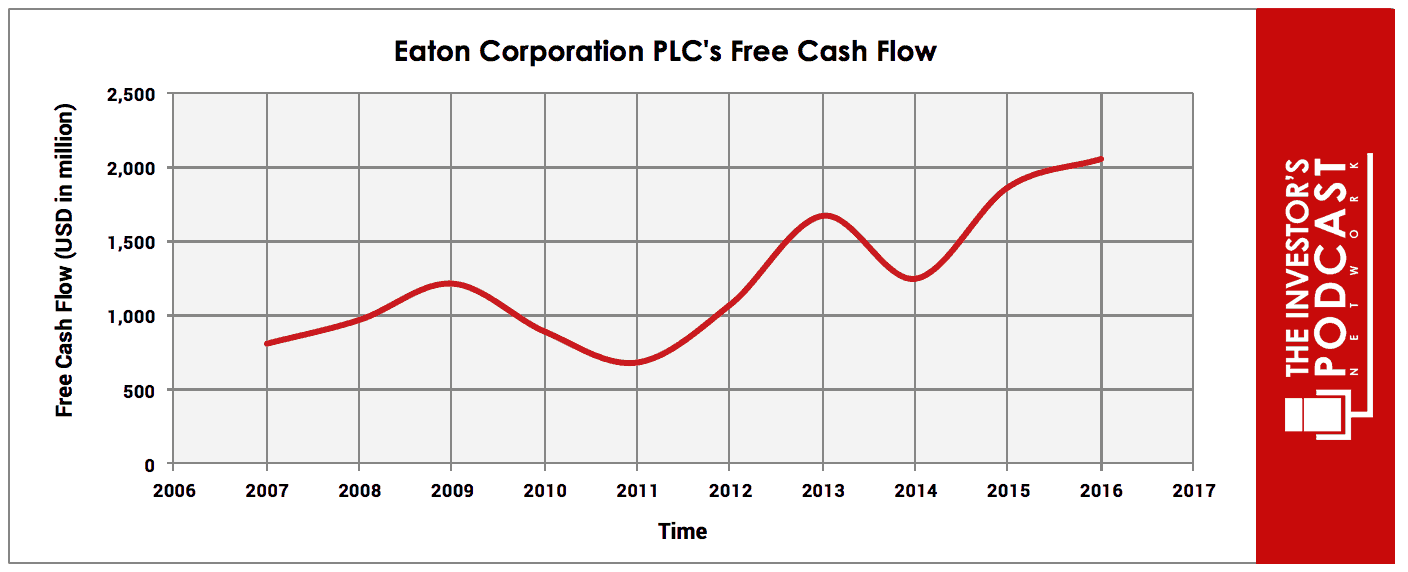

To determine the intrinsic value of Eaton Corporation PLC, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Eaton Corporation PLC’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has been on a moderate upward trend, growing at an annualized rate of around 11% for the past ten years. To determine Eaton Corporation PLC’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

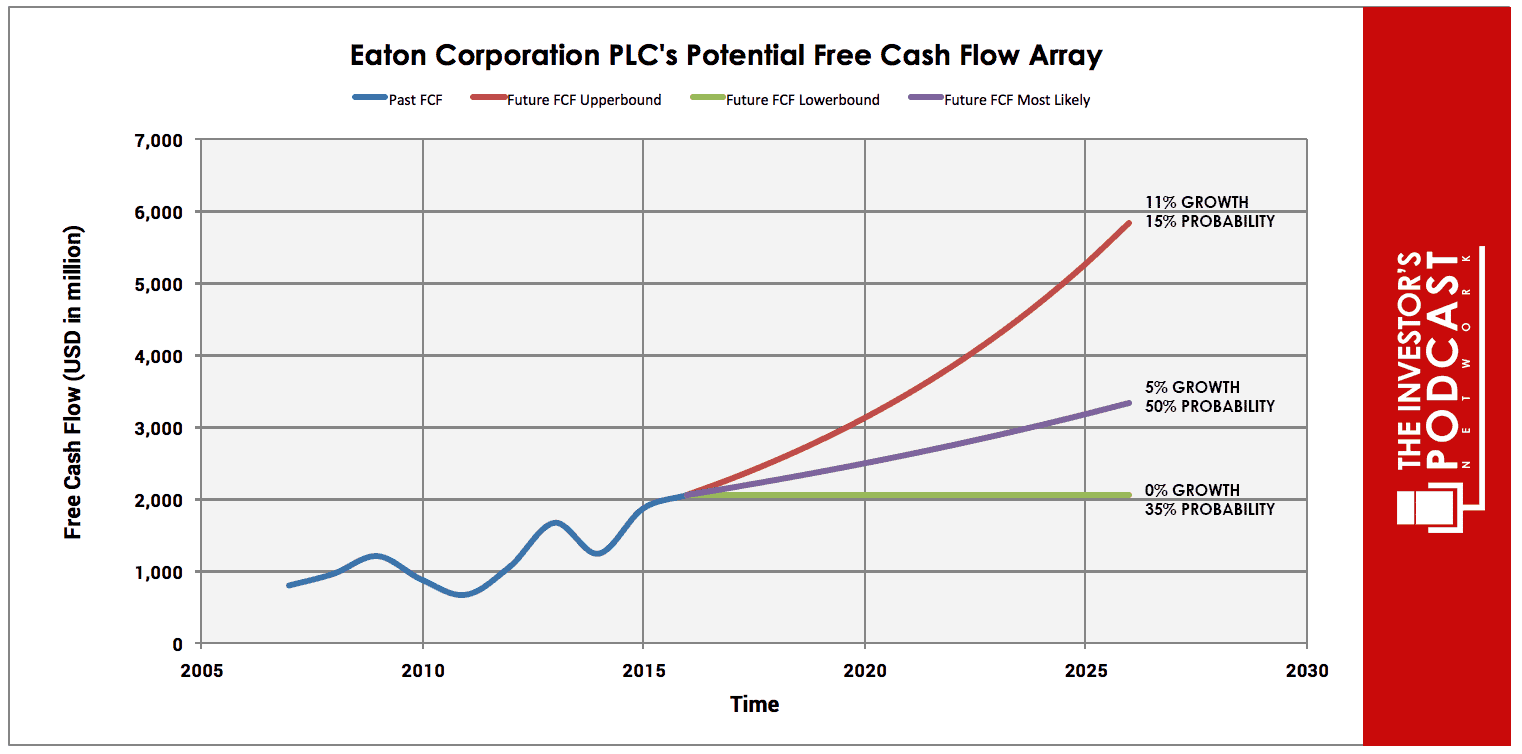

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents an 11% growth rate which is based on the company’s historical rate of free cash flow growth. While the company’s business is diversified across multiple industries and continents, it is not impervious to cyclical pressures. For this reason, the upper-bound rate has been assigned a 15% probability to account for the increasing likelihood of an economic downturn.

The middle growth line represents a 5% growth rate which is based on the company’s historical revenue growth rate. Revenues tend to be far more stable than earnings and offer a more realistic estimate of long-term future growth. For this reason, it has been assigned a 50% probability of occurrence.

The lower bound line represents a 0% growth rate in free cash flow and has been assigned a 35% probability of occurrence. This lower bound rate assumes that the company’s growth stagnates in the event of weakening economic growth.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Eaton Corporation PLC might be priced at a 6.4% annualized return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds to this estimate.

Based on Eaton Corporation PLC’s current earnings yield, which is the inverse of its EV/EBIT ratio, the company is projected to return 7.98%. This is above the firm’s 13-year historical median average of 6.30%, suggesting that the company is marginally undervalued relative to its historical average. Finally, we’ll look at Eaton Corporation PLC’s dividend yield on cost, a metric useful for stable dividend-paying stocks. The company’s current 5-year yield on cost is 5.11%, which is roughly in line with its 13-year historical median of 5.02%. This suggests that the firm is currently fairly valued.

Taking all these points into consideration, it seems reasonable to assume that Eaton Corporation PLC is trading around fair value at present. Furthermore, the company may return around 6-7% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these free cash flows could be realized.

THE COMPETITIVE ADVANTAGE OF EATON CORPORATION PLC

Eaton Corporation PLC has various competitive advantages outlined below.

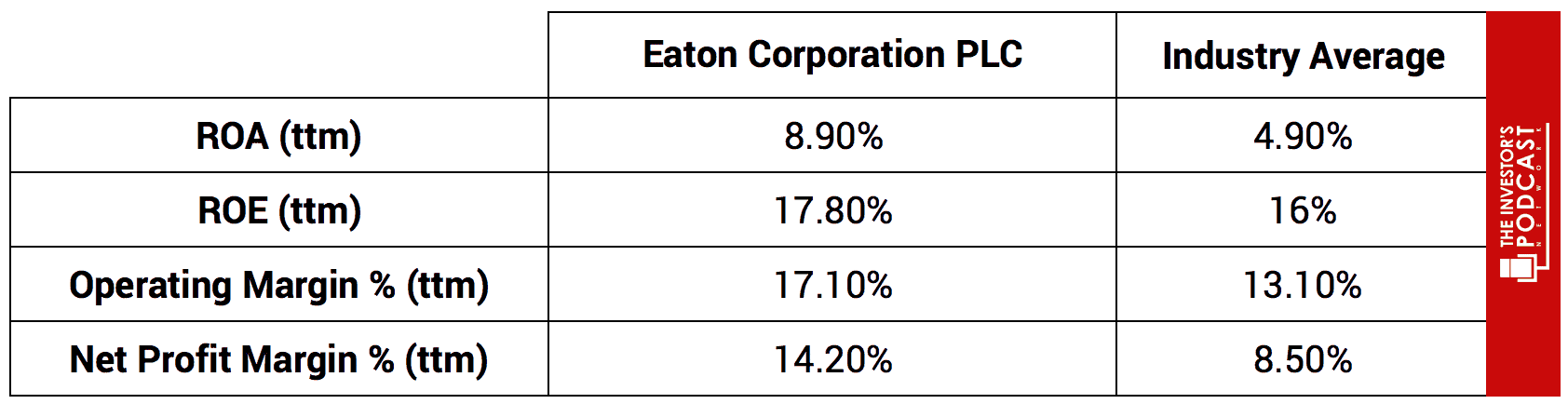

- Economies of scale. Due to Eaton Corporation PLC’s size and scale of operations, it can sustain a lower manufacturing cost structure than many of its competitors. This allows the firm to outperform its peers on some key performance metrics which can be seen in the table below.

- Efficient corporate structure. Eaton Corporation PLC runs an internal assessment system called the ‘Eaton Business System.’ This system of processes and measurements involves the whole workforce and seeks to reduce costs and drive efficiencies. This results in the firm achieving an inventory and receivables turnover of 5.74 and 5.35 respectively, versus an industry average of 3.54 and 4.97.

- Diversified market presence. Eaton Corporation PLC has expanded from its original automotive business to become a comprehensive energy management company spanning several industries including information technology, aerospace, utilities, and This allows the company to adapt to economic cycles more dynamically than most of its peers ensuring that its shareholders continue to see a suitable return on investment regardless of market conditions. The firm has been paying dividends for around 100 years with 34 consecutive years of maintained or increased dividends. In the great recession of 2008, while many industrial firms were cutting or suspending dividends, Eaton Corporation PLC was able to maintain its distributions to shareholders.

EATON CORPORATION PLC’S RISKS

Now that Eaton Corporation PLC’s competitive advantages have been considered, let’s look at some of the risk factors which could impair my assumptions of investment return.

- While Eaton Corporation PLC possesses multiple competitive advantages, there still exists a possibility that one of its rivals could mount a challenge to erode its competitive advantages and move on its market share. It should be noted that some of these competitors, such as 3M Co. and Cummins Inc., possess both their competitive advantages and ample capital to mount a serious challenge.

- Eaton Corporation PLC’s operating results depend on continuing innovation and product development. Failure to maintain this record of innovation would likely see the firm’s economic performance decline given the rapid rate of change in technology.

- The emergence of a serious economic crisis, similar to that witnessed in 2008, could materially impact the company’s revenues and profits leading to lower growth in the coming years. While Eaton Corporation PLC possesses numerous competitive advantages, a major decline in global economic growth would be detrimental to the company’s economic performance.

OPPORTUNITY RISKS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.46%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 33.4x, 98.8% higher than the historical mean of 16.8x. This gives the S&P500 an implied future annual return of -3.3% assuming reversion to the mean occurs. While Eaton Corporation PLC appears to offer a higher rate of return than both US Treasuries and the S&P 500, other individual stocks may be found which may offer a more favorable return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 33.4x. This is 98.8% higher than the historical mean average of 16.8x suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low, suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future for Eaton Corporation PLC looks uncertain at present. Global debt levels are at historically high levels suggesting future economic growth may begin to weaken as demand starts to drop off. There is little doubt that the company’s client base has significant exposure to cyclical pressure and a major economic downturn would almost certainly result in lower revenues and earnings. On the plus side, Eaton Corporation PLC’s current debt and liquidity position look broadly in line with its historical averages which suggests that the company would probably be able to handle a downturn similar to that witnessed in 2008. The company is also on target to complete its four-year $3 Billion share buyback program and intends to purchase a further $800 Million worth of shares in 2018. Management also anticipates market growth of 3% for the coming year and a more favorable tax rate of between 11-13%.

At present, Eaton Corporation PLC appears fairly valued with an estimated return of around 6-7%. While the company’s stock appears to offer a greater rate of return than the market, investors may wish to seek out more compelling opportunities to invest in.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.